Purchase receipts¶

Purchase Receipts are not invoices but rather confirmations of received payments, such as a ticket or a receipt.

This feature is meant to be used when you pay directly with your company’s money for an expense. Vendor Bills, on the other hand, are recorded when an invoice is issued to you and that the amount is first credited on a debt account before a later payment reconciliation.

Note

Expenses paid by employees can be managed with Flectra Expenses, an app dedicated to the approval of such expenses and the payments management. Click here for more information on how to use Flectra Expenses.

Register a receipt¶

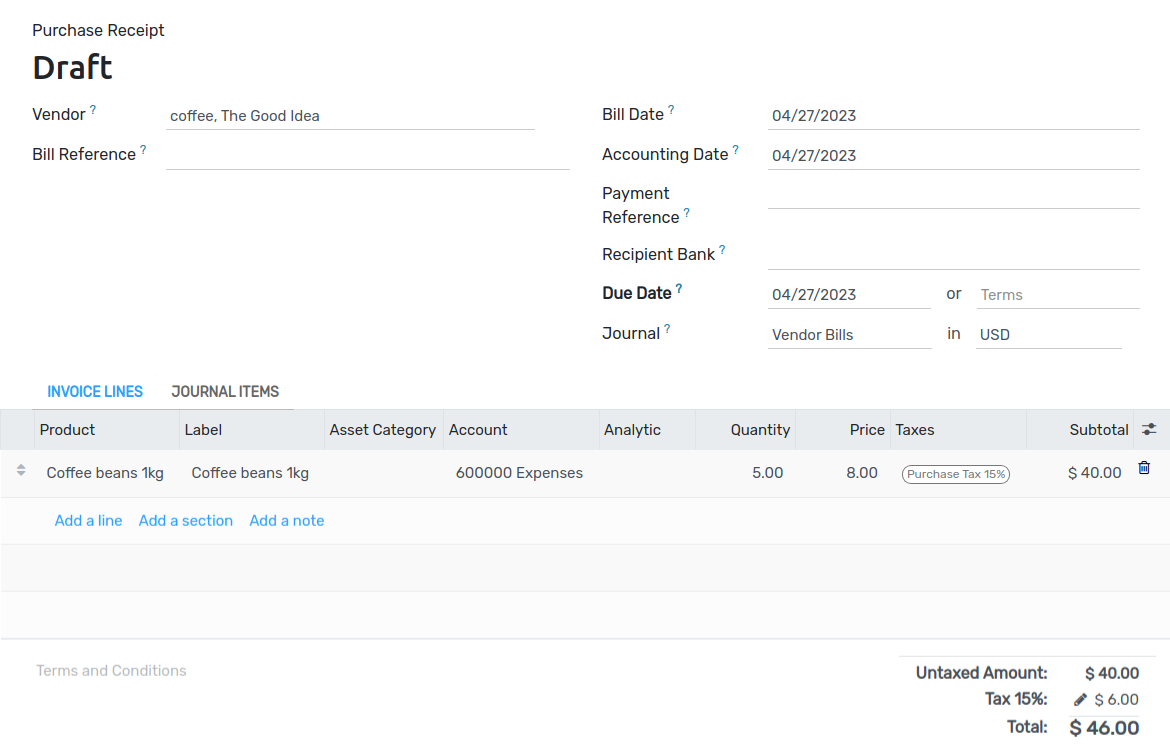

To record a new receipt, go to , click on Create, fill out the form, and click on Post.

You can register the payment by clicking on Register Payment, then filling out the payment’s details, and clicking on Validate.

Edit the Journal Entry before posting it¶

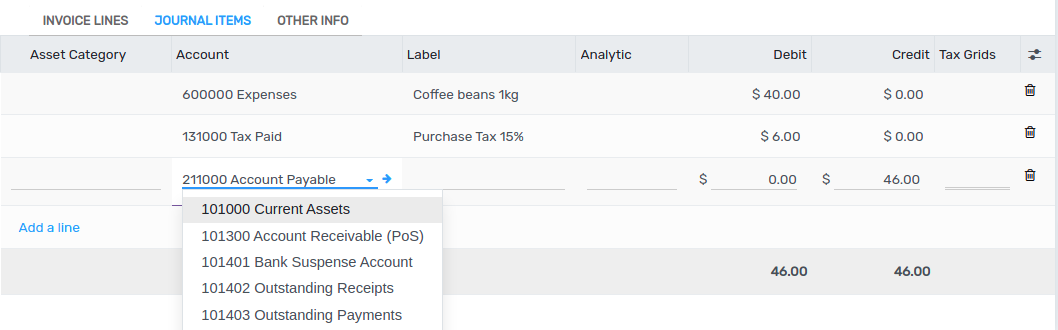

Once you have filled out the Invoice Lines tab, you can modify the Journal Entry before you post it.

To do so, click on the Journal Items tab, change the accounts and values according to your needs, and click on Post.

See also