Bank Statements¶

Importing your bank statements in Flectra Accounting allows you to keep track of the financial movements that occur on your bank accounts and reconcile them with the transactions recorded in your accounting.

However, if you don’t want to use bank synchronization or if your bank is not a supported institution, you still have other options:

Import the bank statement files delivered by your bank

Register the bank statements manually

Import bank statements files¶

Flectra supports multiple file formats to import bank statements:

SEPA recommended Cash Management format (CAMT.053)

Comma-separated values (.CSV)

Open Financial Exchange (.OFX)

Quicken Interchange Format (.QIF)

Belgium: Coded Statement of Account (.CODA)

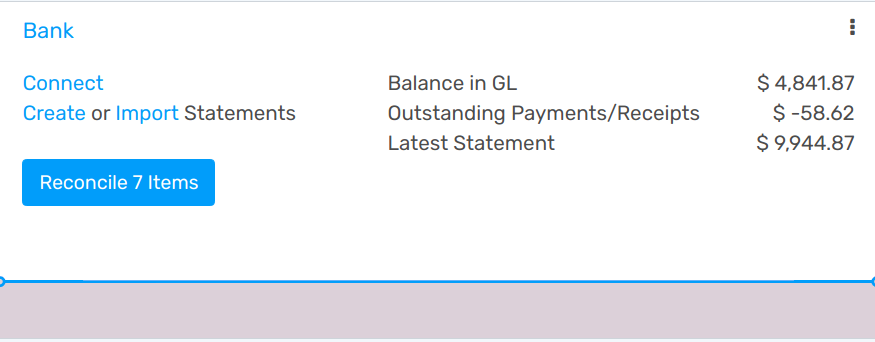

To import them, go to , click on Import Statements, or on the three dots, and then on Import Statement.

Import CSV bank statement files¶

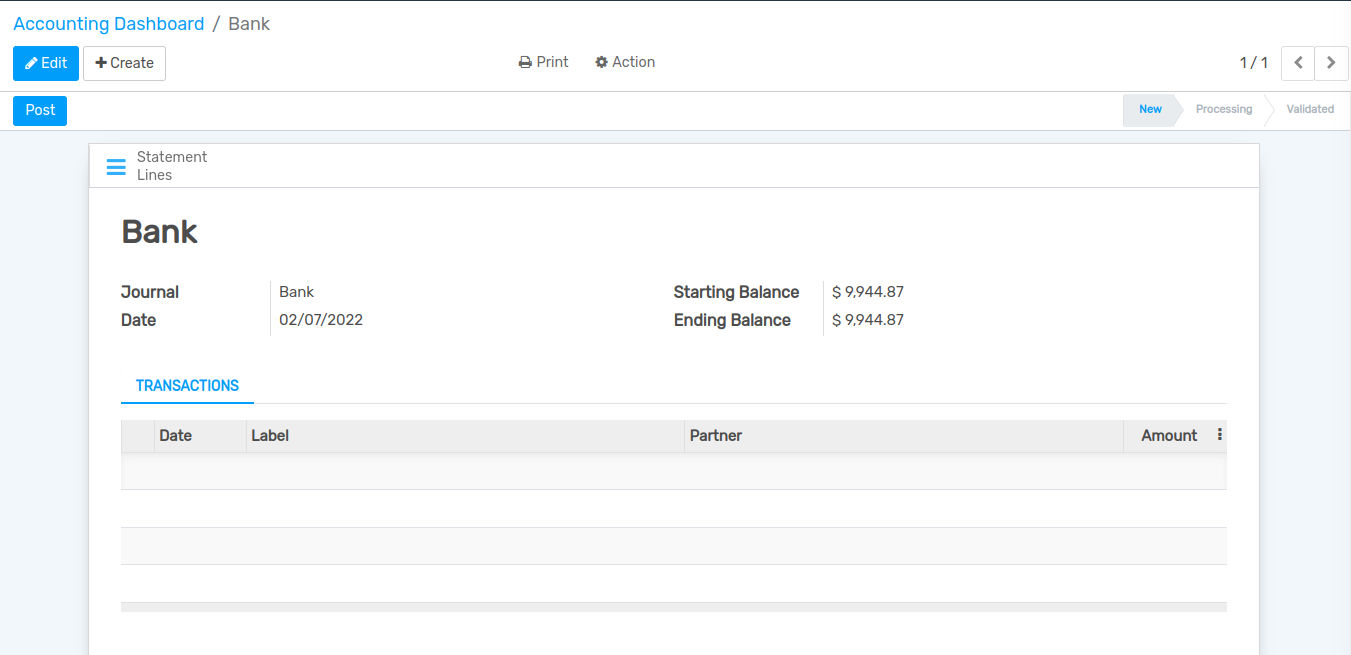

To import them, go to , click on Create.

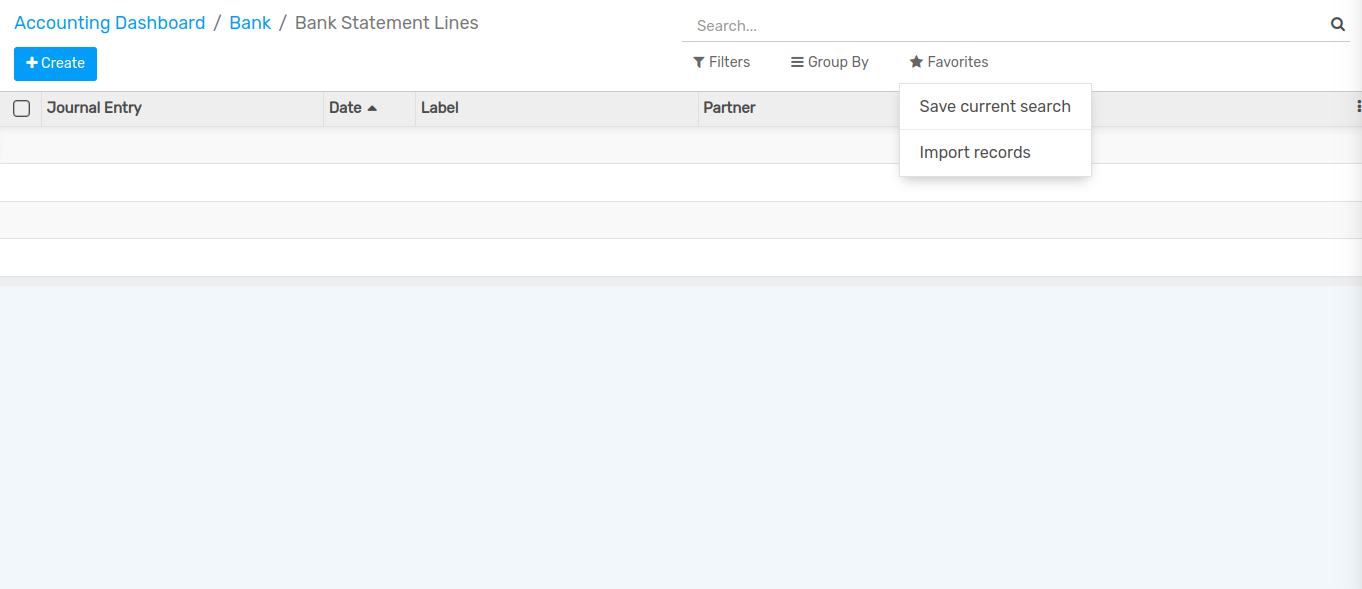

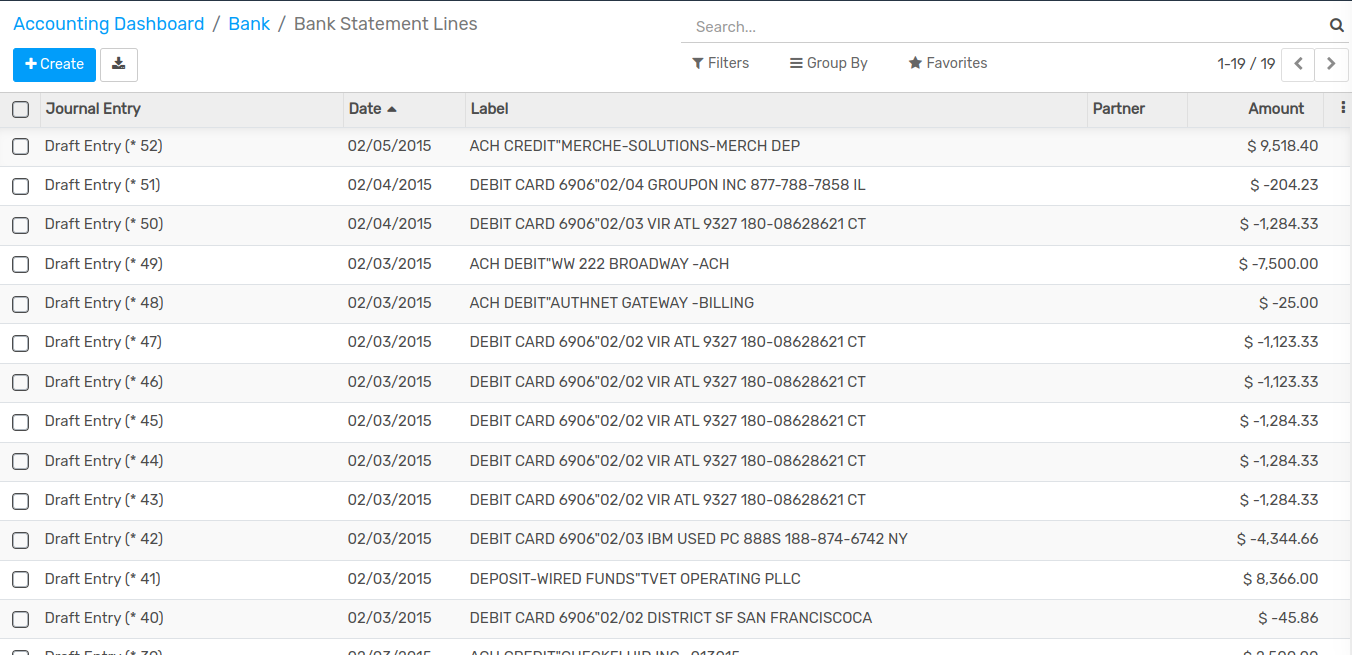

Click on Statement Lines.

Now click on .

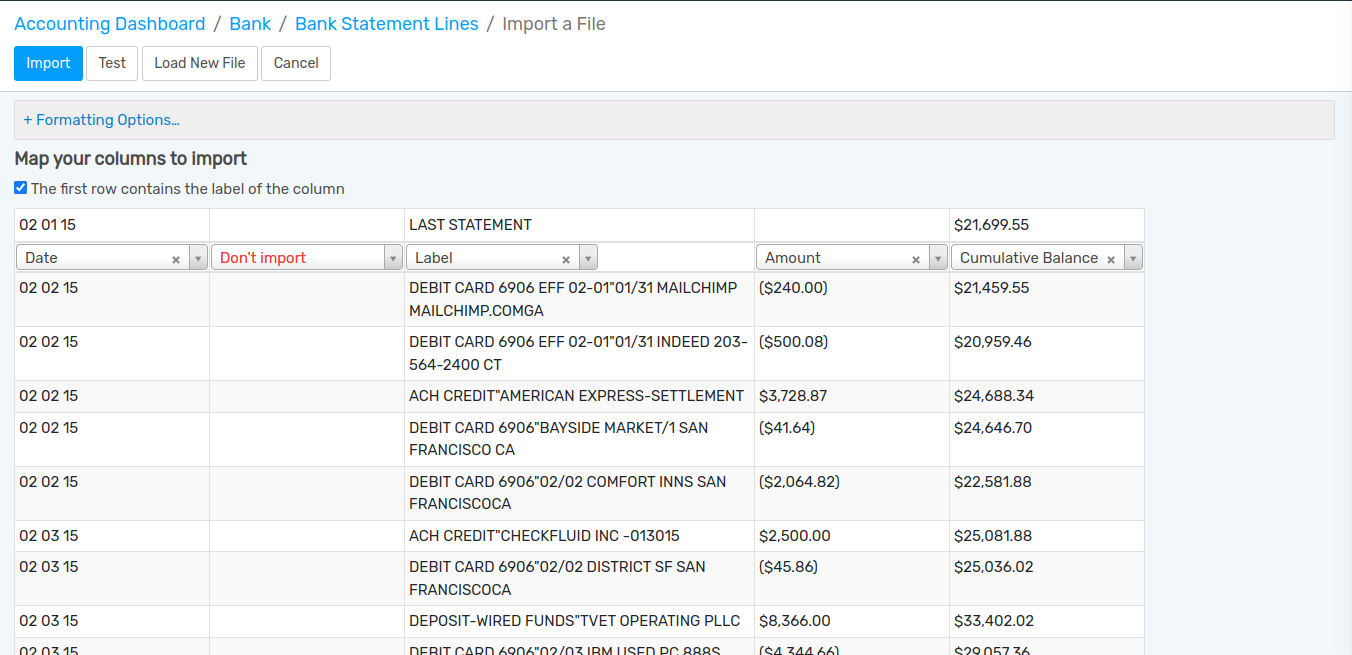

Here you can upload the csv file of statement and click on Import button.

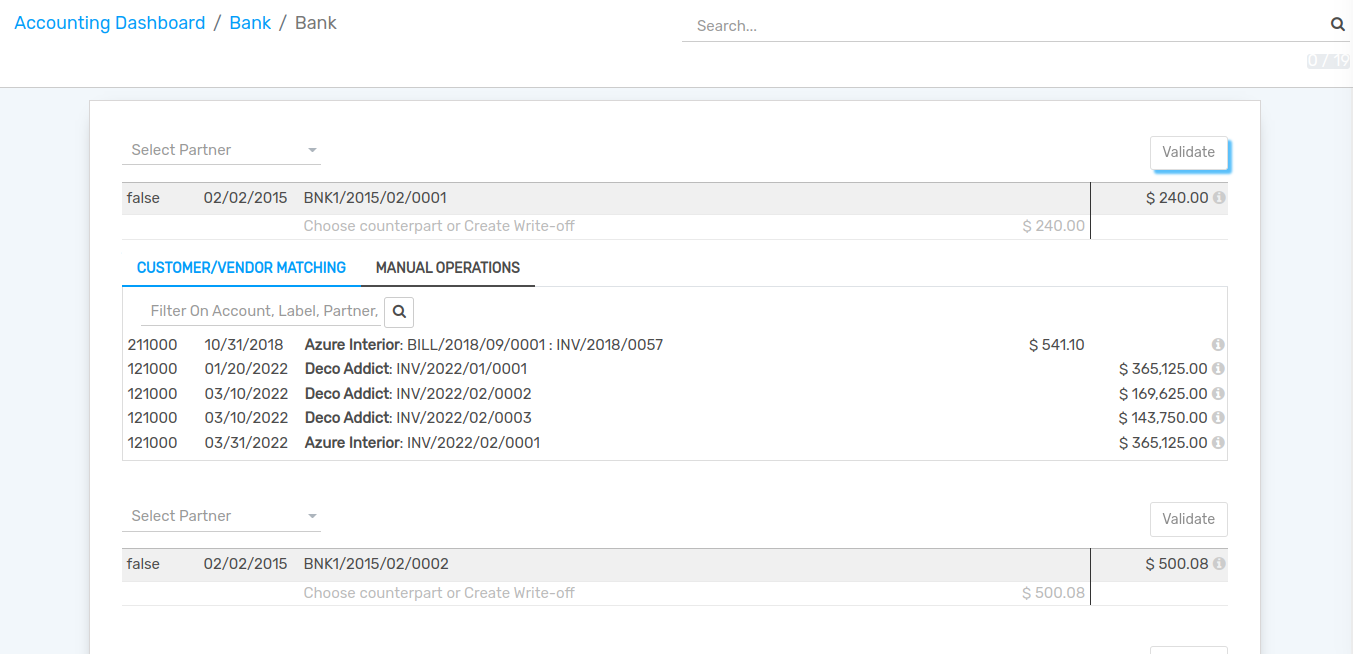

Here you can see transactions and reconcile it by clicking on Reconcile button.

Register bank statements manually¶

If needed, you can also record your bank statements manually.

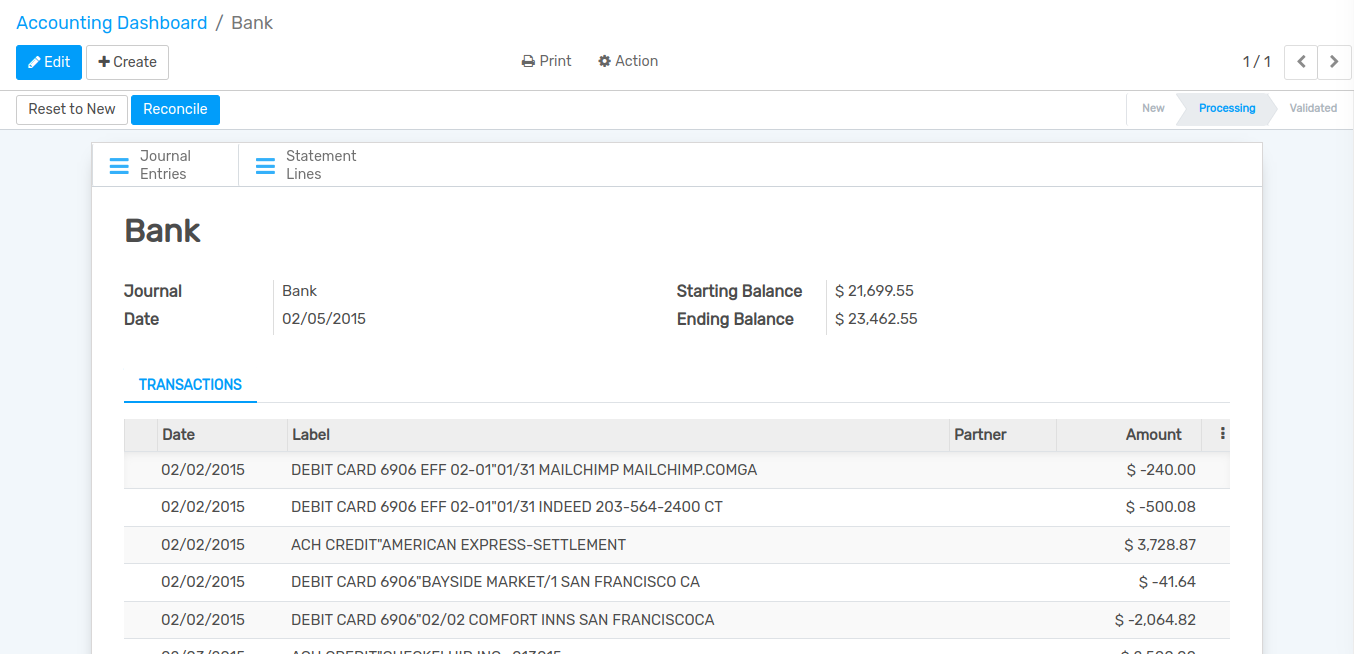

To do so, go to , click on Create Statements, or on the three dots, and then on New Statement.

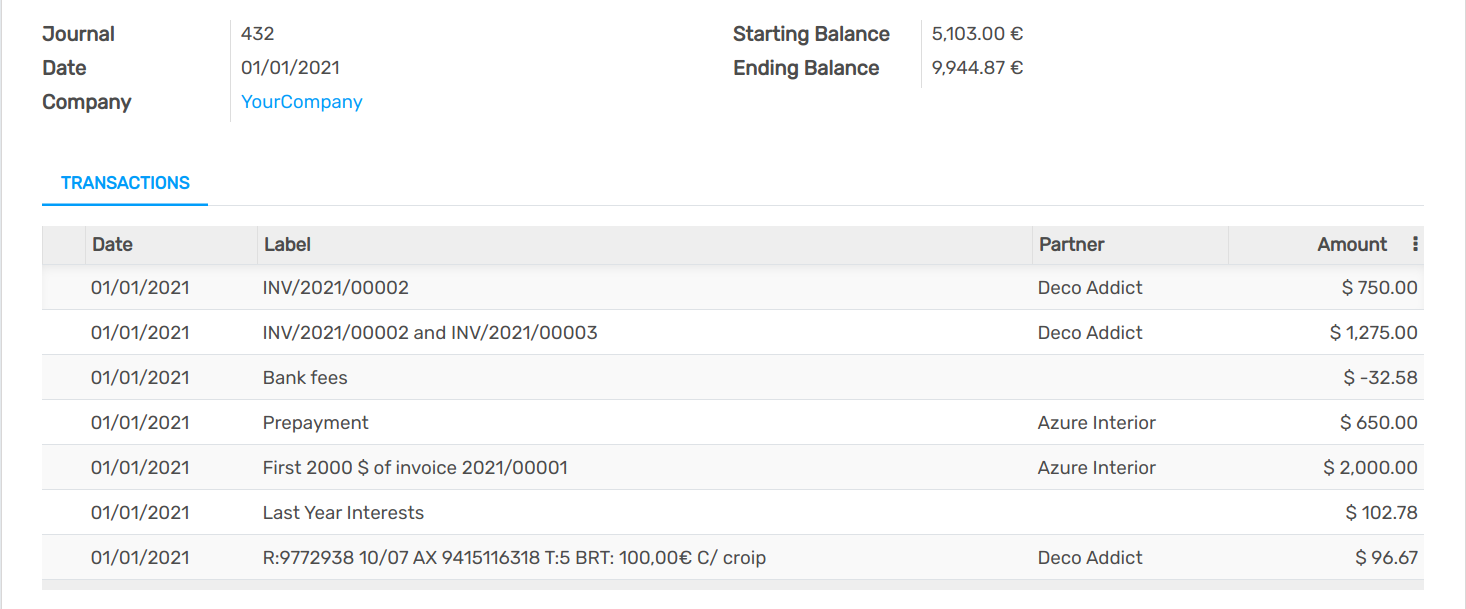

Add a new line for each transaction written on the original bank statement.

To ease the reconciliation process, make sure to fill out the Partner field. You can also write the payments’ references in the Label field.

Note

The Ending Balance and the Computed Balance should have the same amount. If it is not the case, make sure that there is no mistake in the transactions’ amounts.