Payment Acquirers (Credit Cards, Online Payment)¶

Flectra embeds several payment methods that allow your customers to pay on their Customer Portals or your eCommerce website. They can pay Sales Orders, invoices, or subscriptions with recurring payments with their favorite payment acquirers, including online payment providers that accept Credit Cards.

Having several payment methods increases the chances of getting paid in time, or even immediately, as you make it more convenient for your customers to pay with the payment method they prefer and trust.

Important

Flectra does not keep Credit Card numbers or credentials on its servers, nor is it stored on Flectra databases hosted elsewhere. Instead, Flectra apps use a unique reference to the data stored in the payment acquirers’ systems, where the information is safely stored. This reference is useless without your credentials for the payment acquirer.

Payment Acquirers¶

From an accounting perspective, we can distinguish two types of payment acquirers: the payments that go directly on the bank account and follow the usual reconciliation workflow, and the payment acquirers that are third-party services and require you to follow another accounting workflow.

Bank Payments¶

Online Payment Providers¶

Redirection to the acquirer website |

Payment from Flectra |

Save Cards |

Capture Amount Manually |

|

|---|---|---|---|---|

Adyen |

✔ |

|||

Alipay |

✔ |

|||

✔ |

✔ |

✔ |

✔ |

|

Buckaroo |

✔ |

|||

Ingenico |

✔ |

✔ |

✔ |

|

✔ |

||||

PayUMoney |

✔ |

|||

SIPS |

✔ |

|||

Stripe |

✔ |

✔ |

✔ |

Note

Some of these Online Payment Providers can also be added as Bank Accounts, but this is not the same process as adding them as Payment Acquirers. Payment Acquirers allow customers to pay online, and Bank Accounts are added and configured on your Accounting app to do a bank reconciliation, which is an accounting control process.

Configuration¶

Some of the features described in this section are available only with some Payment Acquirers. Refer to the table above for more details.

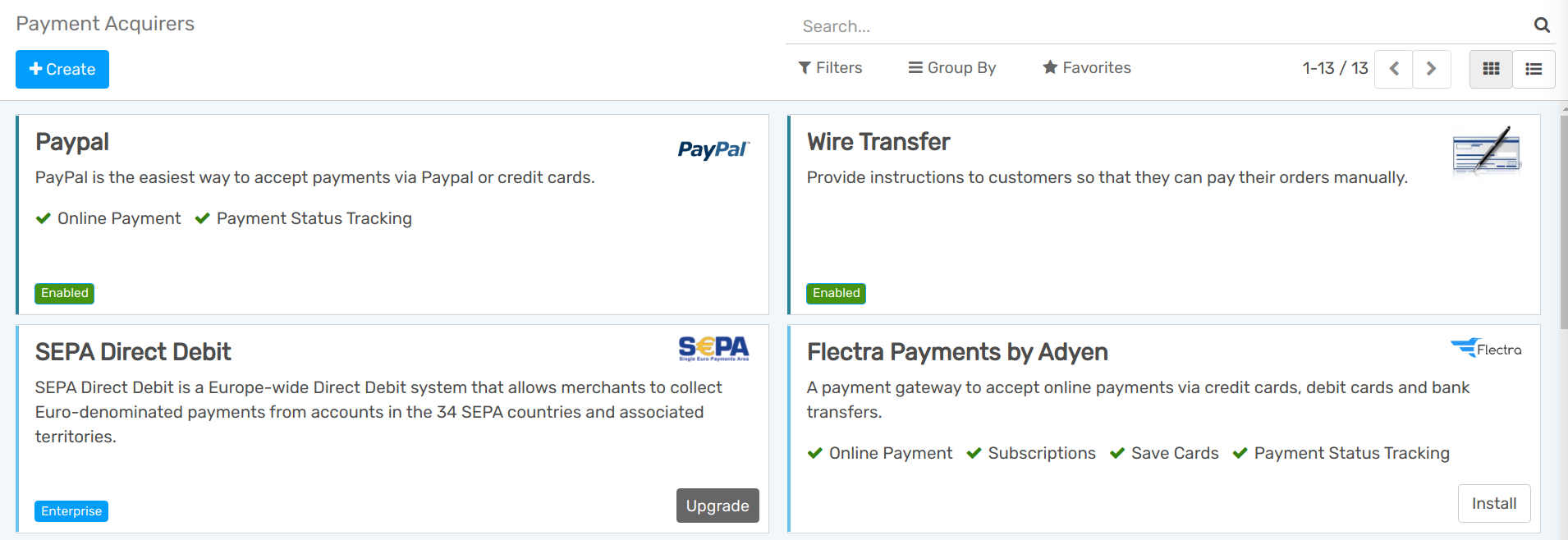

Add a new Payment Acquirer¶

To add a new Payment acquirer and make it available to your customers, go to , look for your payment acquirer, install the related module, and activate it. To do so, open the payment acquirer and change its state from Disabled to Enabled.

Warning

We recommend using the Test Mode on a duplicated database or a test database. The Test Mode is meant to be used with your test/sandbox credentials, but Flectra generates Sales Orders and Invoices as usual. It isn’t always possible to cancel an invoice, and this could create some issues with your invoices numbering if you were to test your payment acquirers on your main database.

Credentials tab¶

If not done yet, go to the Online Payment Provider’s website, create an account, and make sure to have the credentials required for third-party use. Flectra requires these credentials to communicate with the Payment Acquirer and get the confirmation of the payment authentication.

The form in this section is specific to the Payment Acquirer you are configuring. Please refer to the related documentation for more information.

Configuration tab¶

You can change the Payment Acquirer front-end appearance by modifying its name under the Displayed as field and which credit card icons to display under the Supported Payment Icons field.

Save and reuse Credit Cards¶

With the Save Cards feature, Flectra can store Payment Tokens in your database, which can be used for subsequent payments, without having to reenter the payment details. This is particularly useful for subscriptions’ recurring payments.

Place a hold on a card¶

If the Capture Amount Manually field is enabled, the funds are reserved for a few days on the customer’s card, but not charged yet. You must then go to the related Sales Order and manually capture the funds before its automatic cancellation, or void the transaction to unlock the funds from the customer’s card.

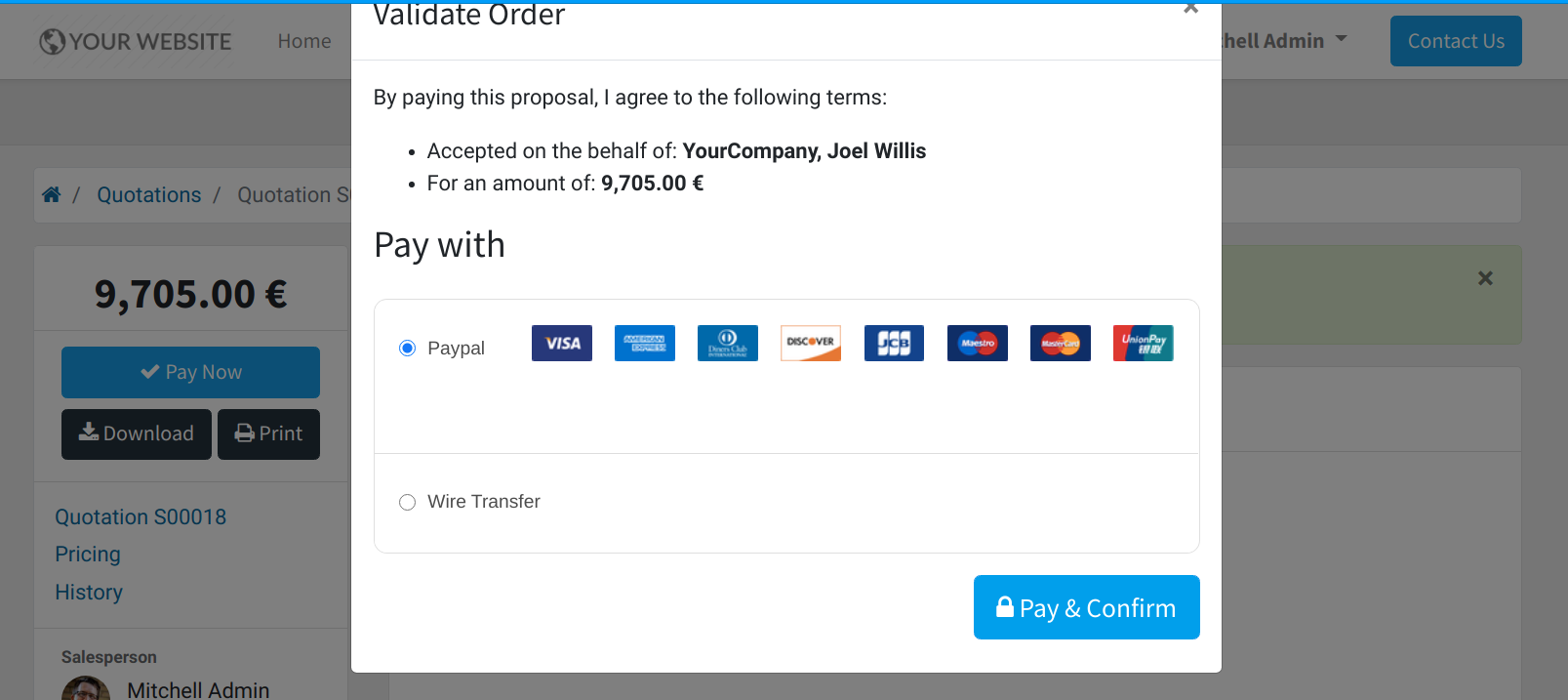

Payment Flow¶

Choose in the Payment Flow field if to redirect the user to the payment acquirer’s portal to authenticate the payment, or if to stay on the current page and authenticate the payment from Flectra.

Note

Some features are available only if you select Redirection to the acquirer website.

Countries¶

Restrict the use of the Payment Acquirer to a selection of countries. Leave this field blank to make the Payment Acquirer available to all countries.

Payment Journal¶

The Payment Journal selected for your Payment Acquirer must be a Bank journal.

Important

In many cases, Flectra automatically creates a new Journal and a new Account when you activate a new Payment Acquirer. Both of them are preset to work out-of-the-box, but we strongly recommend you to make sure these fields are correctly set according to your accounting needs, and adapt them if necessary.

Messages tab¶

Change here the messages displayed by Flectra after a payment’s confirmation or failure.

Accounting perspective¶

The Bank Payments that go directly to one of your bank accounts follow their usual reconciliation workflows. However, payments recorded with Online Payment Providers require you to consider how you want to record your payments’ journal entries. We recommend you to ask your accountant for advice.

Flectra default method is to record the payments on a Current Assets Account, on a dedicated Bank Journal, once the Payment Authentication is confirmed. At some point, you transfer the funds from the Payment Acquirer to your Bank Account.

Here are the requirements for this to work:

Bank Journal

The Journal’s type must be Bank Journal.

Select the right Default Debit Account and Default Credit Account.

- Under the Advanced Settings tab, make sure that Posting is set as Post At Payment Validation.This implies that the Journal Entry is recorded directly when your Flectra database receives the confirmation of the Payment Authentication from the Online Payment Provider.

Current Asset Account

The Account’s type is Current Assets

The Account must Allow Reconciliation

Note

In many cases, Flectra automatically creates a new Journal and a new Current Asset Account when you activate a new Payment Acquirer. You can modify them if necessary.