Deferred Expenses and Prepayments¶

Deferred expenses and prepayments (also known as prepaid expense), are both costs that have already occurred for unconsumed products or services yet to receive.

Such costs are assets for the company that pays them since it already paid for products and services still to receive or that are yet to be used. The company cannot report them on the current Profit and Loss statement, or Income Statement, since the payments will be effectively expensed in the future.

These future expenses must be deferred on the company’s balance sheet until the moment in time they can be recognized, at once or over a defined period, on the Profit and Loss statement.

For example, let’s say we pay $ 1200 at once for one year of insurance. We already pay the cost now but haven’t used the service yet. Therefore, we post this new expense in a prepayment account and decide to recognize it on a monthly basis. Each month, for the next 12 months, $ 100 will be recognized as an expense.

Flectra Accounting handles deferred expenses and prepayments by spreading them in multiple entries that are automatically created in draft mode and then posted periodically.

Note

The server checks once a day if an entry must be posted. It might then take up to 24 hours before you see a change from draft to posted.

Prerequisites¶

Such transactions must be posted on a Deferred Expense Account rather than on the default expense account.

Configure a Deferred Expense Account¶

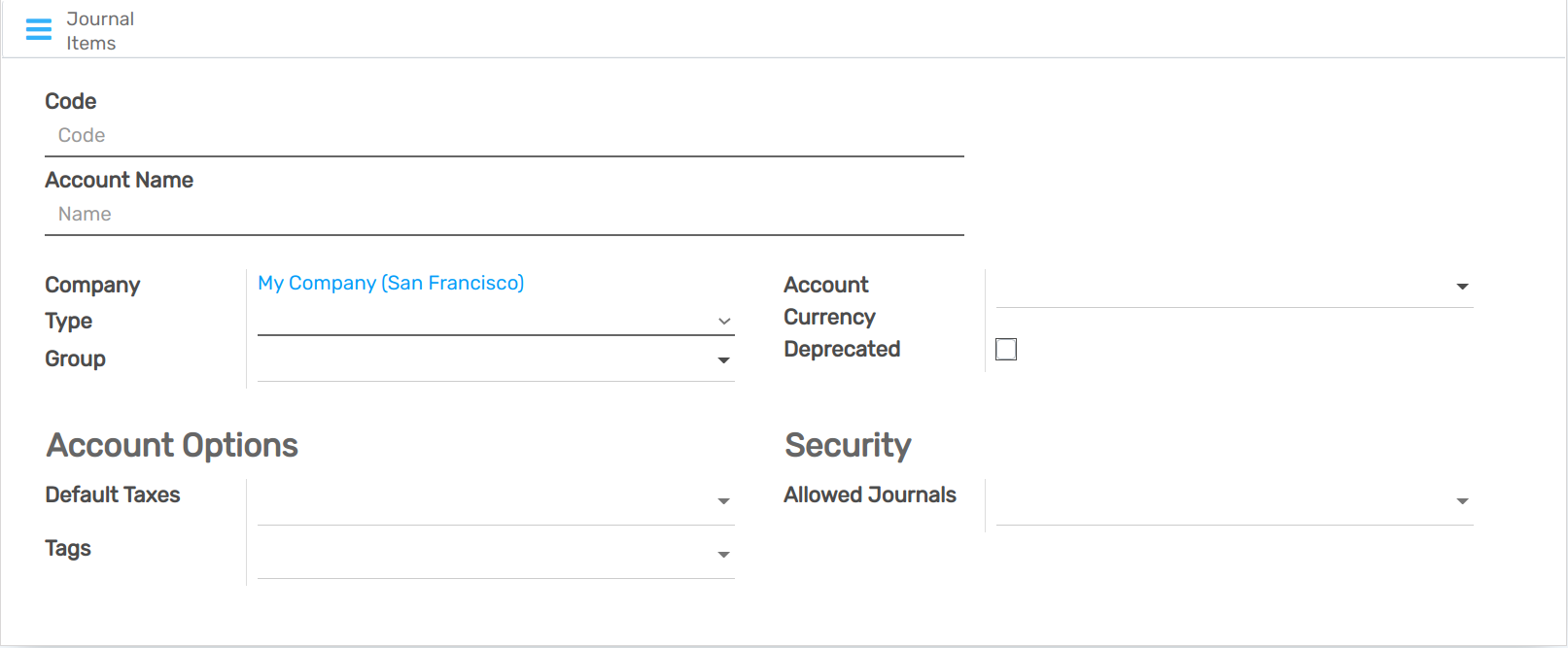

To configure your account in the Chart of Accounts, go to , click on Create, and fill out the form.

Note

This account’s type must be either Current Assets or Prepayments

Post an expense to the right account¶

Select the account on a draft bill¶

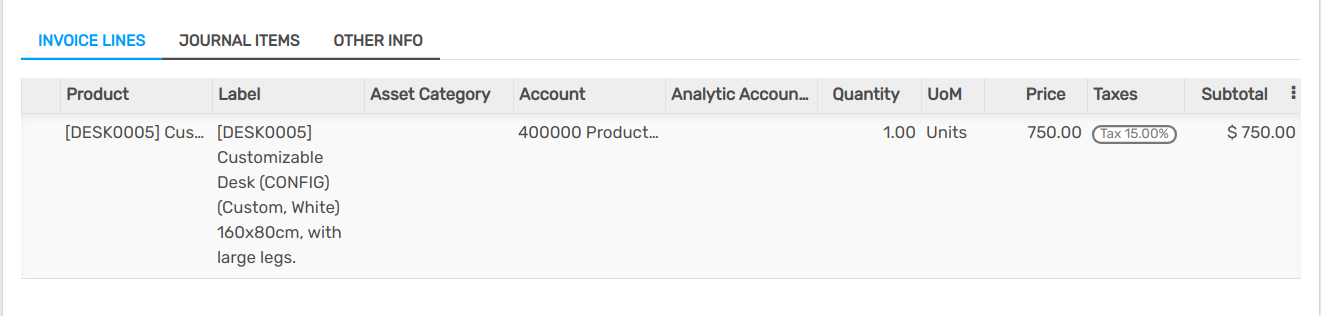

On a draft bill, select the right account for all the products of which the expenses must be deferred.

Choose a different Expense Account for specific products¶

Start editing the product, go to the Accounting tab, select the right Expense Account, and save.

Change the account of a posted journal item¶

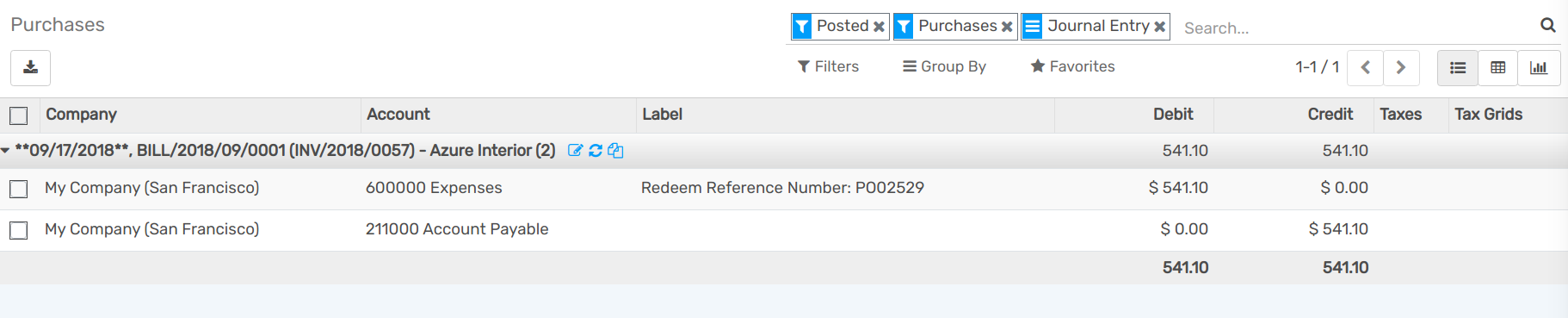

To do so, open your Purchases Journal by going to , select the journal item you want to modify, click on the account, and select the right one.