Chart of Accounts¶

The Chart of Accounts (COA) is the list of all the accounts used to record financial transactions in the general ledger of an organization.

The accounts are usually listed in the order of appearance in the financial reports. Most of the time, they are listed as follows :

Balance Sheet accounts

Assets

Liabilities

Equity

Profit & Loss

Income

Expense

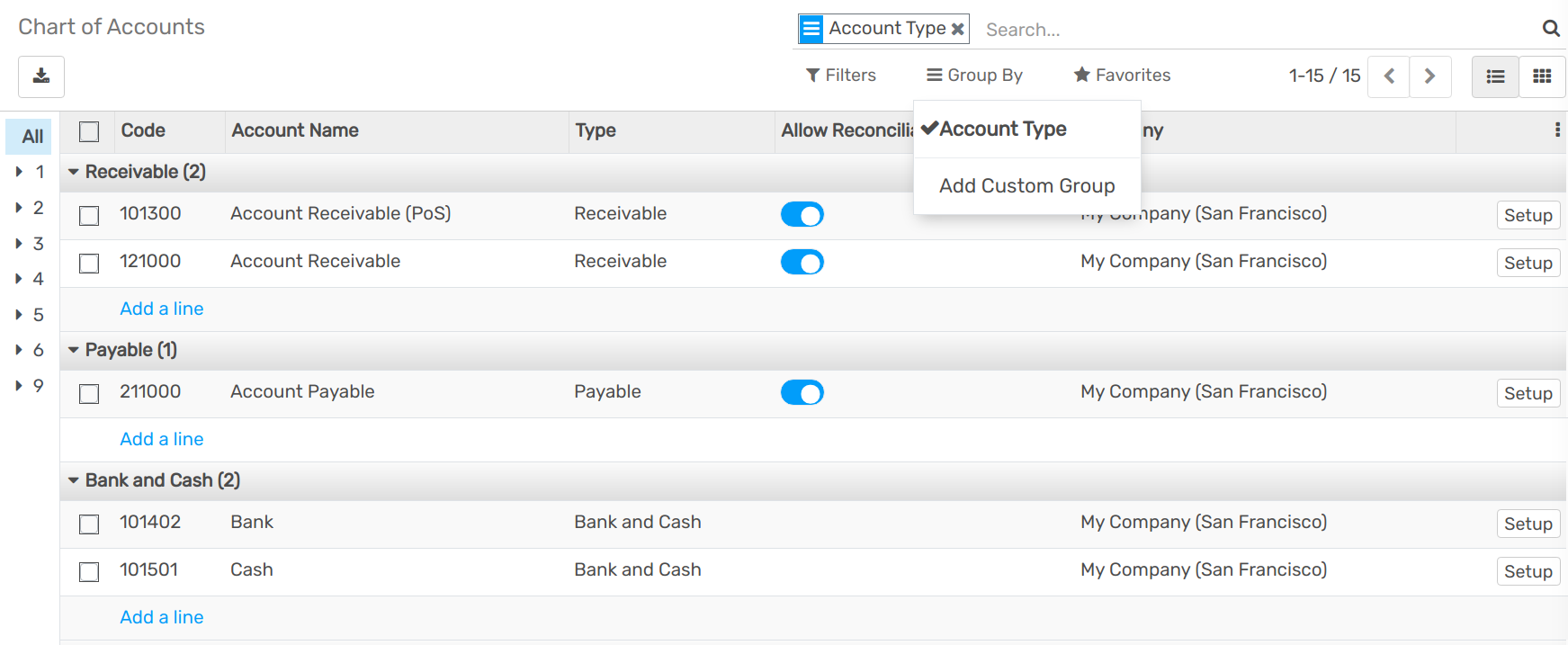

When browsing your Chart of Accounts, you can filter the accounts by number, in the left column, and also group them by Account Type.

Configuration of an Account¶

The country you select at the creation of your database (or additional company on your database) determines which Fiscal Localization Package is installed by default. This package includes a standard Chart of Accounts already configured according to the country’s regulations. You can use it directly or set it according to your company’s needs.

Warning

It is not possible to modify the Fiscal Localization of a company once a Journal Entry has been posted.

To create a new account, go to , click on Create, and fill out the form.

Code and Name¶

Each account is identified by its Code and Name, which also indicates the account’s purpose.

Type¶

Configuring correctly the Account Type is critical as it serves multiple purposes:

Information on the account’s purpose and behavior

Generate country-specific legal and financial reports

Set the rules to close a fiscal year

Generate opening entries

To configure an account type, open the Type field’s drop-down selector and select the right type among the following list:

Report |

Category |

Account Types |

|---|---|---|

Balance Sheet |

Assets |

Receivable |

Bank and Cash |

||

Current Assets |

||

Non-current Assets |

||

Prepayments |

||

Fixed Assets |

||

Liabilities |

Payable |

|

Credit Card |

||

Current Liabilities |

||

Non-current Liabilities |

||

Equity |

Equity |

|

Current Year Earnings |

||

Profit & Loss |

Income |

Income |

Other Income |

||

Expense |

Expense |

|

Depreciation |

||

Cost of Revenue |

||

Other |

Other |

Off-Balance Sheet |

Assets, Deferred Expenses, and Deferred Revenues Automation¶

You have three choices for the Automation field:

No: this is the default value. Nothing happens.

Create in draft: whenever a transaction is posted on the account, a draft entry is created, but not validated. You must first fill out the corresponding form.

Create and validate: you must also select a Model. Whenever a transaction is posted on the account, an entry is created and immediately validated.

Note

Please refer to the related documentation for more information.

Default Taxes¶

Select a default tax that will be applied when this account is chosen for a product sale or purchase.

Allow Reconciliation¶

Some accounts, such as accounts made to record the transactions of a payment method, can be used for the reconciliation of journal entries.

For example, an invoice paid with a credit card can be marked as paid if reconciled with the payment. Therefore, the account used to record credit card payments needs to be configured as allowing reconciliation.

To do so, check the Allow Reconciliation box and save.

Deprecated¶

It is not possible to delete an account once a transaction has been recorded on it. You can make them unusable by using the Deprecated feature.

To do so, check the Deprecated box and save.