Default Taxes¶

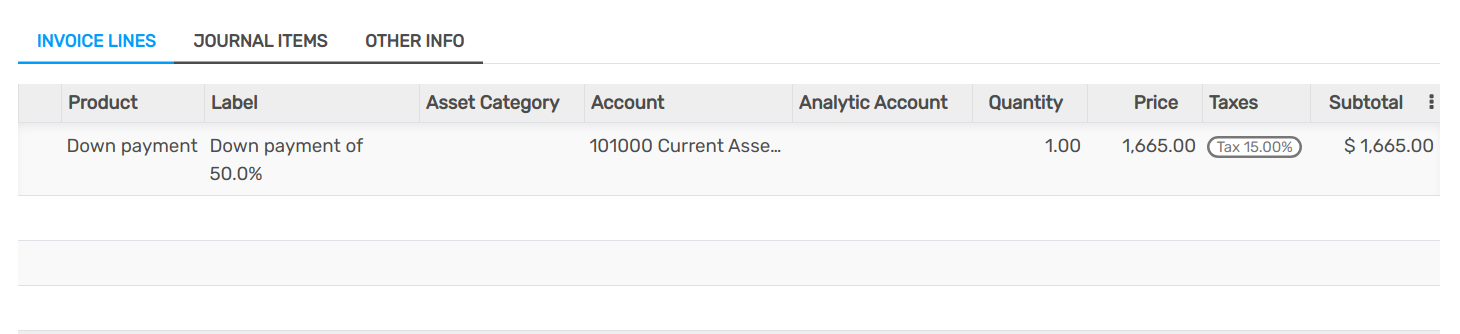

Default Taxes define which taxes are automatically selected when there is no other indication about which tax to use. For example, Flectra prefills the Taxes field with the Default Taxes when you create a new product or add a new line on an invoice.

Important

Fiscal Positions take the Default Tax into account. Therefore, if a Fiscal Position is applied to an invoice, Flectra applies the related tax instead of the Default Taxes, as mapped in the Fiscal Position.

Configuration¶

Default Taxes are automatically set up according to the country selected at the creation of your database, or when you set up a Fiscal Localization Package for your company.

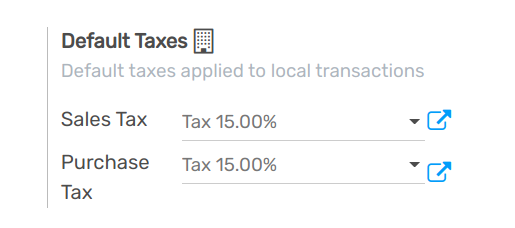

To change your Default Taxes, go to , select the appropriate taxes for your default Sales Tax and Purchase Tax, and click on Save.

Note

Databases with multiple companies: the Default Taxes values are company-specific.