Fiscal Positions (tax and account mapping)¶

Default taxes and accounts are set on products and customers to create new transactions on the fly. However, you might have to use different taxes and record the transactions on different accounts, according to your customers’ and providers’ localizations and business types.

Fiscal Positions allow you to create sets of rules to automatically adapt the taxes and the accounts used for a transaction.

They can be applied in various ways:

Note

A few Fiscal Positions are already preconfigured on your database, as part of your Fiscal Localization Package.

Configuration¶

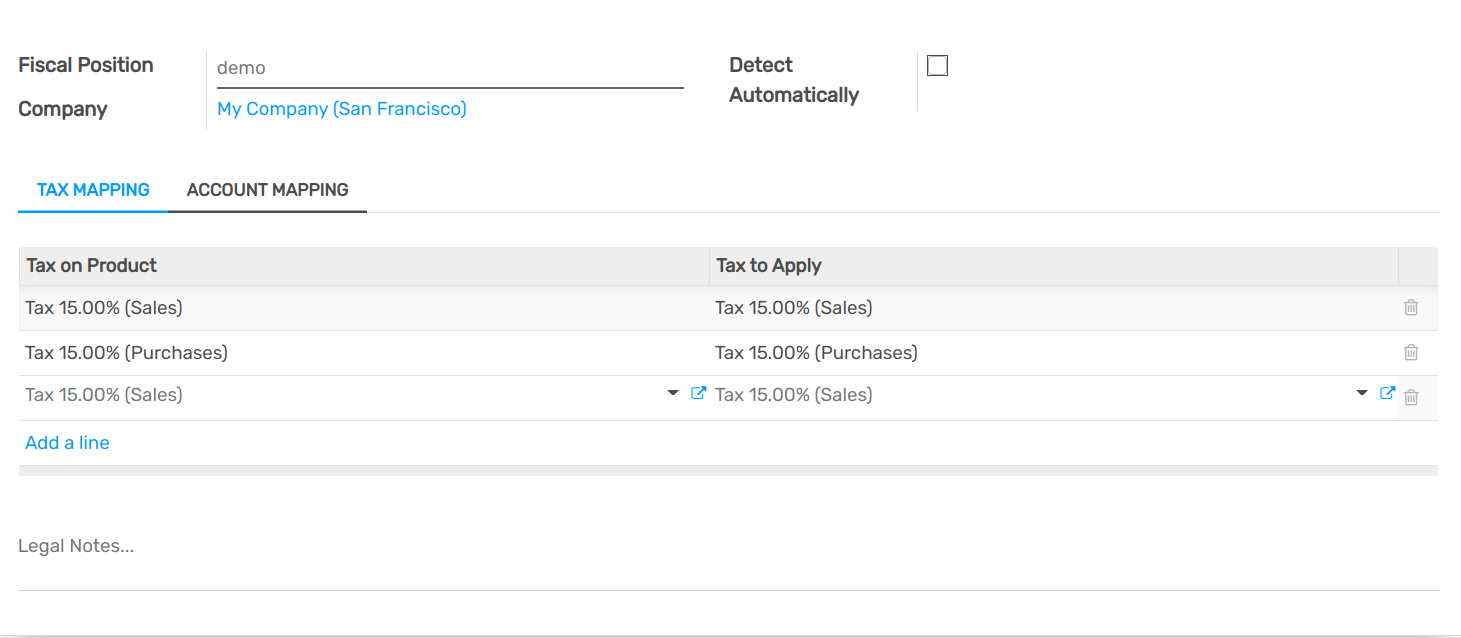

Tax and Account Mapping¶

To edit or create a Fiscal Position, go to , and open the entry you want to modify or click on Create.

The mapping of taxes and accounts is based on the default taxes and accounts defined in the products’ forms.

To map to another tax or account, fill out the right column (Tax to Apply/Account to Use Instead).

To remove a tax, rather than replacing it with another, leave the field Tax to Apply empty.

To replace a tax with multiple other taxes, add multiple lines with the same Tax on Product.

Note

The mapping only works with active taxes. Therefore, make sure they are active by going to .

Automatic application¶

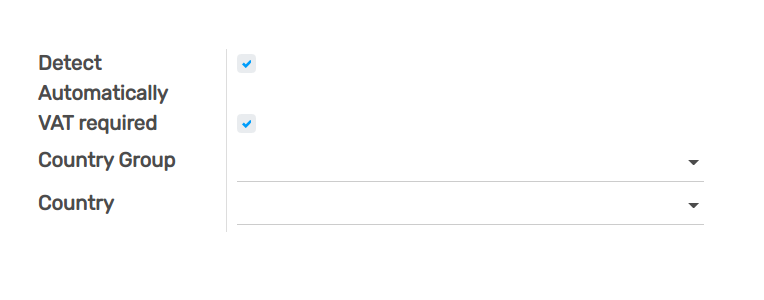

You can configure your Fiscal Positions to be applied automatically, following a set of conditions.

To do so, open the Fiscal Position you want to modify and click on Detect Automatically. You can configure a few conditions:

VAT Required: The VAT number must be indicated in the customer’s contact form.

Country Group / Country: The Fiscal Position is applied to these countries.

Note

Taxes on eCommerce orders are automatically updated once the visitor has logged in or filled out their billing details.

Important

The Fiscal Positions’ sequence - the order in which they are arranged - defines which Fiscal Position to apply if the conditions are met in multiple Fiscal Positions.

For example, if the first Fiscal Position targets country A, and the second Fiscal Position targets a Country Group that also comprises country A, only the first Fiscal Position will be applied to customers from country A.

Application¶

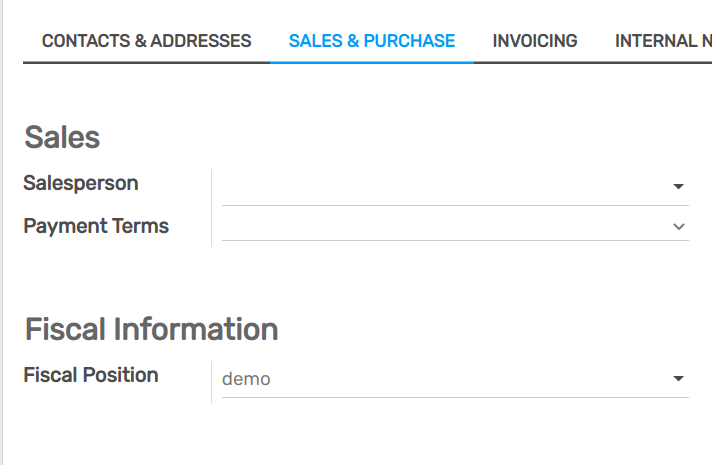

Assign a Fiscal Position to a partner¶

You can manually define which Fiscal Position must be used by default for a specific partner.

To do so, open the partner’s contact form, go to the Sales & Purchase tab, edit the Fiscal Position field, and click on Save.

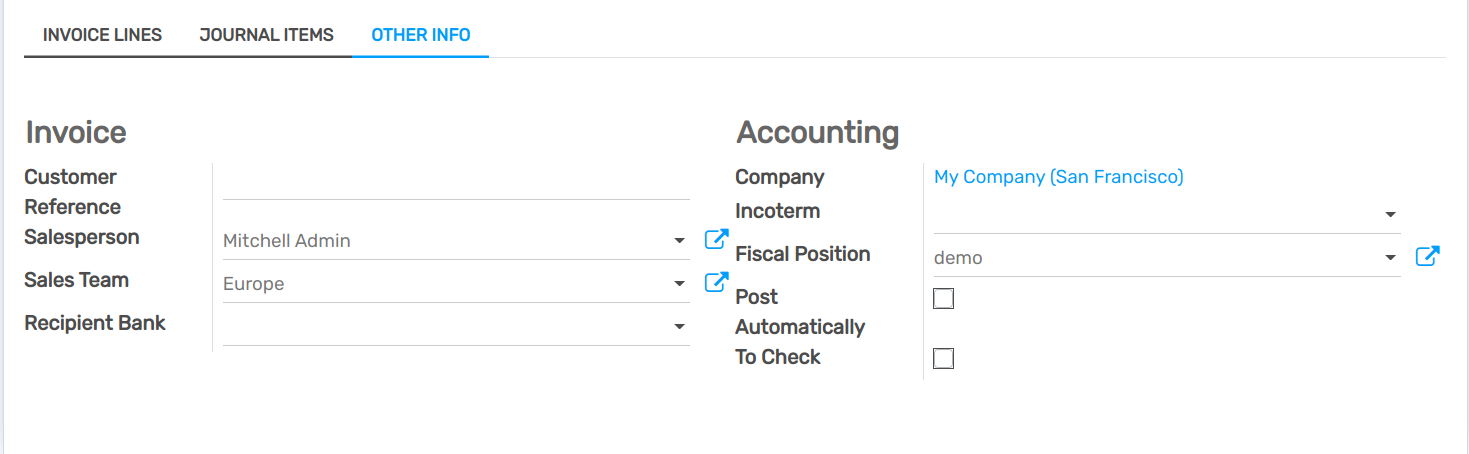

Choose Fiscal Positions manually on Sales Orders, Invoices, and Bills¶

To manually select which Fiscal Position to use for a new Sales Order, Invoice, or Bill, go to the Other Info tab and select the right Fiscal Position before adding product lines.

See also